We have noticed this month that the ATO has started sending out monthly IAS’s to clients who previously did not receive them.

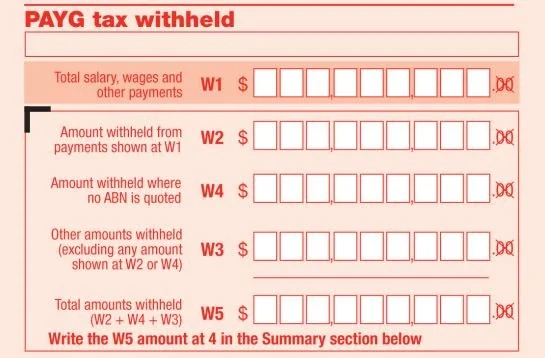

You may have had your PAYG tax withholding (for wages) obligations included in the quarterly BAS for your business, however if you have gone over the ATOs annual PAYG Tax withholding threshold, you will now be paying the obligations monthly.

What does this mean?

Towards the end of each month, you will now receive an IAS where you report the total PAYG tax withheld for that month, you will also need to lodge the IAS and pay the obligation by its due date (usually the month after).

You will still be required to complete and lodge a quarterly BAS’, however your PAYG withholding for 1 month (the last month of that quarter) will be included in the BAS.

For example:

Quarter 1= 1 July – 30 September

An IAS will be sent for July & August months.

BAS will still be received for the quarter (towards the end of September)however the PAYG withholding obligation will be included only for September, therefore maintaining the monthly reporting of PAYG tax withholding. The rest of the BAS information will be for the quarter (GST received & paid).

If you have received an IAS and you are not certain how to complete it or would like to discuss it further, please feel free to contact our office. We are here to clarify things for you.